When things don’t go as planned for your business, and you cannot do much about your income, be it as a result of a global downturn or a local demand shortage, it’s time to look at your costs. There are two types of costs or expenses in your business that serve two different purposes: Direct costs and Indirect costs.

The Direct costs are the costs that you incur because you are making and delivering your particular service or product. We published some solutions to control your Direct Costs in a previous post.

The Indirect costs are the costs that you pay in order to maintain the infrastructure of your business. That is, irrespective of whether you sell the same thing that you are selling today. Let’s take office costs – you will still pay for office if you sold something different tomorrow or nothing at all (at least for a while). Same with sales and marketing costs – you will still incur some sort of sales bonus or promotional marketing expenses, should you decide to sell apples instead of pears.

All Direct and Indirect cost can be variable or fixed. Usually, Indirect Costs are fixed or vary so little that you might as well consider them fixed costs. Think office rent and utilities.

Variability happens when costs appear only as a result of, and in direct proportion to, activity. For example, delivery transport cost for your product or services, provided you don’t pay a subscription – each time you deliver, you cause a cost. Should you stop the delivery, that cost disappears. Some costs have only one part that is variable – for example: extra charge on phone bills for international/roaming calls when you start selling internationally.

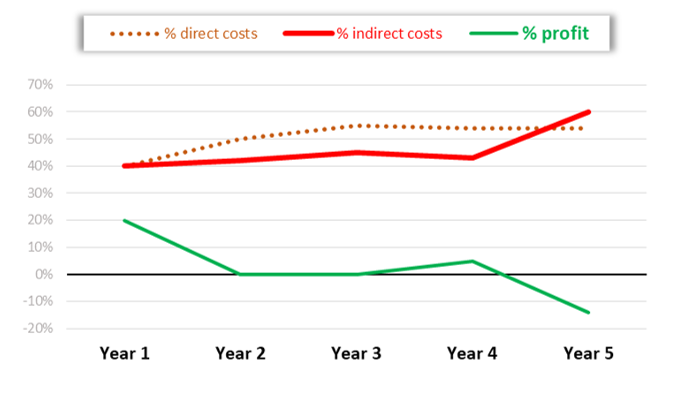

Let’s try an example. Assume you are looking at the following end of year results:

Note that the Indirect costs increased in Year 4 to support the increase in income. Because the increase in income was substantial, the actual percentage of Indirect costs went down. But, since you contracted mostly fixed costs, here is what happens when things then go down in Year 5:

This is a visualisation of the above scenarios – the increase in Indirect costs created a ‘step’ in costs and the step dented your profit:

First, prevention is control

What’s happening is that Indirect cost tend to increase and stubbornly stay there, due to their fixed nature. When you have a stepped fixed cost – like a move to a bigger office, hiring admin help or upgrading your office equipment – it pushes costs up permanently (unless you make a dramatic change). Once you reach a higher ‘step’ in your costs, climbing down is always painful.

Always be aware when you are creating cost steps.

The best solution is preventative action: think twice before you upgrade/invest/get something bigger. You know all this intuitively, but most likely you can’t help it as this makes you an entrepreneur – you are eternally optimistic and always anticipate growth and get ready for it. However, try these as guides:

- Make sure you have measured the performance of your team, and you are at full capacity before you get a new employee

- Check your financial projection is solid, and the growth has been sufficiently robust before you upgrade internally

- Don’t rush to sign a subscription contract because it seems cheaper overall but may become a burden later.

Can you climb down the step of your Indirect costs?

Yes, but it takes a long time. In our experience about 1½ years. The Indirect costs have an inertia – you cannot come out of the office lease quickly enough without a penalty, depreciation of the new equipment takes time, you change contracts with suppliers for lower fees, but you pay a double fee in parallel until the transfer happens. If you try to cut costs by laying people off, your income will suffer immediately – in small businesses, every person counts.

Second, you want the percentage of Indirect costs to go down year on year, like in Year 4 above

In an ideal world, when revenue goes up, your Indirect costs should not increase, and consequently, they should go down as a percentage of income. That can be achieved by increasing the variability of your Indirect costs.

Can you build more variability into your Indirect costs?

You can try to build in some variability in your Indirect Costs in order to avoid a sudden climb-down and the changes driven by a sudden slash of fixed costs.

How to build variability into Indirect cost – the order of action:

- Find out which of your fixed costs is the highest percentage out of revenue. Is it rent? Phone bills? Marketing budget?

- Find alternatives that could offer you variability – can someone work from home and save on rent? Can you switch to pay as you go on something?

- Finally, test your spending – will cancelling certain fancy expenses for a while affect your clients, or have they not even noticed that you were spending on that*?

*Most expenses we saw in this fancy category fell under: Skype subscription, social media campaigns and new logo/website/stationary.

Most of the time, it is enough just to know where variability lies and what percentages each type of cost represents to get you going to maintain percentages and match the variations in revenue. However, if you feel overwhelmed by the idea of looking your costs in the eye, let us do it for you.